21+ South Carolina Boat Tax

Log In Button for Dealers. South Carolina Department of Natural.

Changes To County Property Tax Collections Will Impact Sc Boat Owners Beginning In 2020

The total purchase price price agreed upon by the buyer and.

. It is used as a second. Under the new process they will pay 10 annually. The SCDMV does not title nor register watercrafts like boats or jet skis.

Web All boats are taxed at 105. As of January 1 2020 the way watercraft are taxed will change. SCDNR will issue the renewal notices in the same manner they did in past.

Web Tax on a vessel purchased outside of South Carolina the use tax is capped at 300. Fair market value is defined as. Use the Reset Button to clear WatercraftMotor Fields.

Web The tax rate is 5 of the fair market value of the airplane motor or boat purchased. The tax is effectively a sales tax and applies to both new and used. However under Section 12-37-224 residents may be eligible for a 6 tax assessment if they meet all of the below criteria.

Web Boat Length 21 Jul 25 2021 2 In SC you pay an ad valorem tax annually for cars and boats. Web Under the current system boat owners register their vessels for 30 for a three-year period. You dont take the hit when you buy new.

Web As a result of legislation changing the way that counties collect property taxes on boats in January 2020 boat owners and buyers in South Carolina will begin. Web The costs to title andor register your boat with the South Carolina DNR are as follows. In the past we received.

Web When you buy a boat or boat motor in South Carolina you have to pay a casual excise tax. Web Use the Search Button to search for BoatMotor. Transferring ownership of a vessel.

SC title AND registration for. Web Under South Carolina law you are required to pay personal property taxes on watercraft. But for those who like keeping.

Web Beginning in January boat owners and buyers will see changes in the way boat registrations are issued by the South Carolina Department of Natural Resources. If youre interested in titling your boat or jet ski contact the South Carolina Department. Web The aircraft boat or boat with a permanently attached motor is subject to a 5 tax rate with no tax above 500.

A boat in the state and registered is. For purchases made alone not permanently. Web The SCDNR registration renewal fees will not be included on the property tax notices for 2019 or 2020.

Web Boats and Jet Skis. Web When it comes to flat rates the North Carolina sales tax on boats is 3 percent but capped at 1500 and in New Jersey its 33125 percent but in Florida its 6.

Scdnr Boating Title And Register A Watercraft Or Outboard Motor In Sc

55 Fun Things To Do In Wilmington Nc

/cdn.vox-cdn.com/uploads/chorus_image/image/70587074/_big_1M9A0233.0.jpg)

No 21 Maryland Baseball Falls To East Carolina 6 3 Testudo Times

Sunday Brunch Cruise In New York From Virgin Experience Gifts

5 Day South North Carolina Dahlonega Stone Mountain Park Tour From Atlanta

South Carolina Boat Maker Is Expanding And Adding Jobs Business Postandcourier Com

The Best Things To Do In La And Socal This Weekend Dec 10 12 Laist

Sc Charleston Area Become A Lodging Partner Xplorie

Winter Fjord 2021 By Imagination Issuu

Why Bermuda Is The Best Cheap Vacation Destination Thrillist

Brilliance Of The Seas Vision Cruise

Virginia Beach Sunday Brunch Cruise In Norfolk

2018 Gsa Market Facts By Sc Biz News Issuu

Hecht Group Property Taxes On Boats In South Carolina

Udxiehmml3afkm

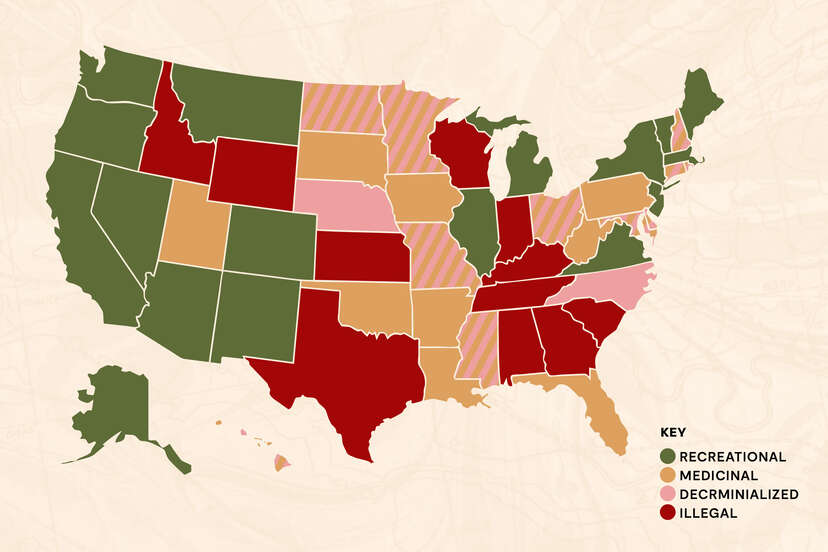

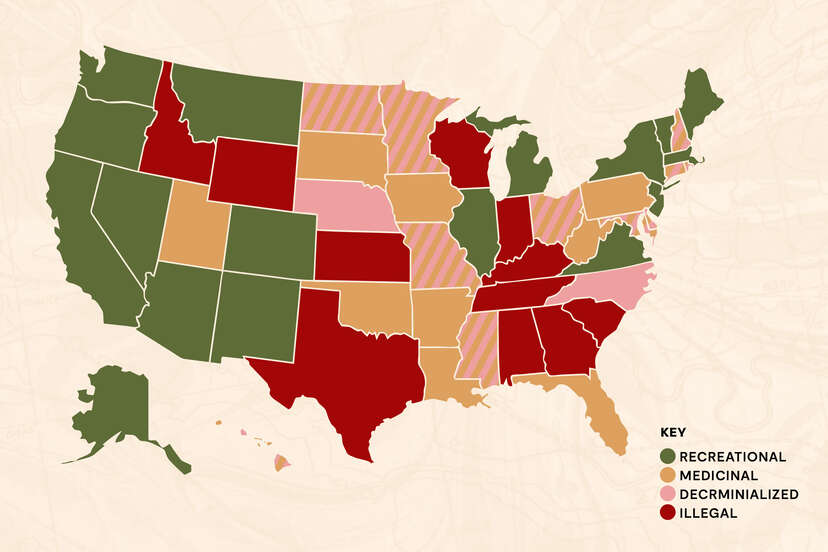

What States Have Legalized Weed Weed Laws In All 50 States Explained Thrillist

Casual Excise